43 generation skipping trust diagram

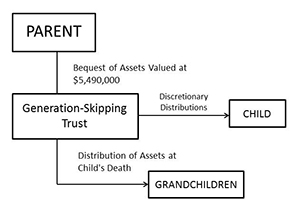

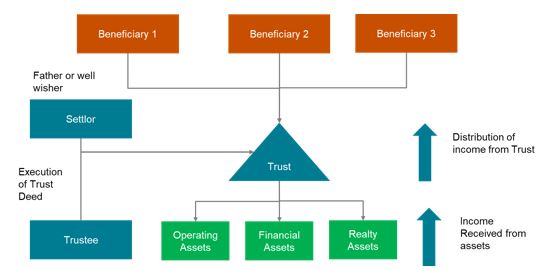

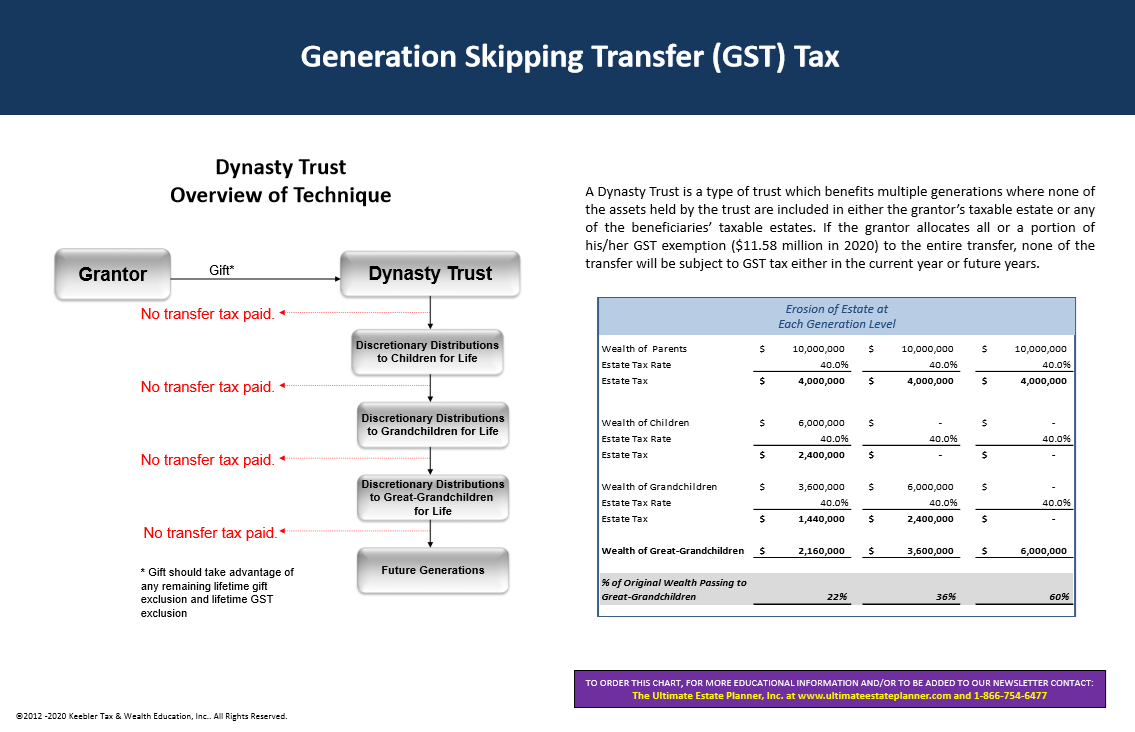

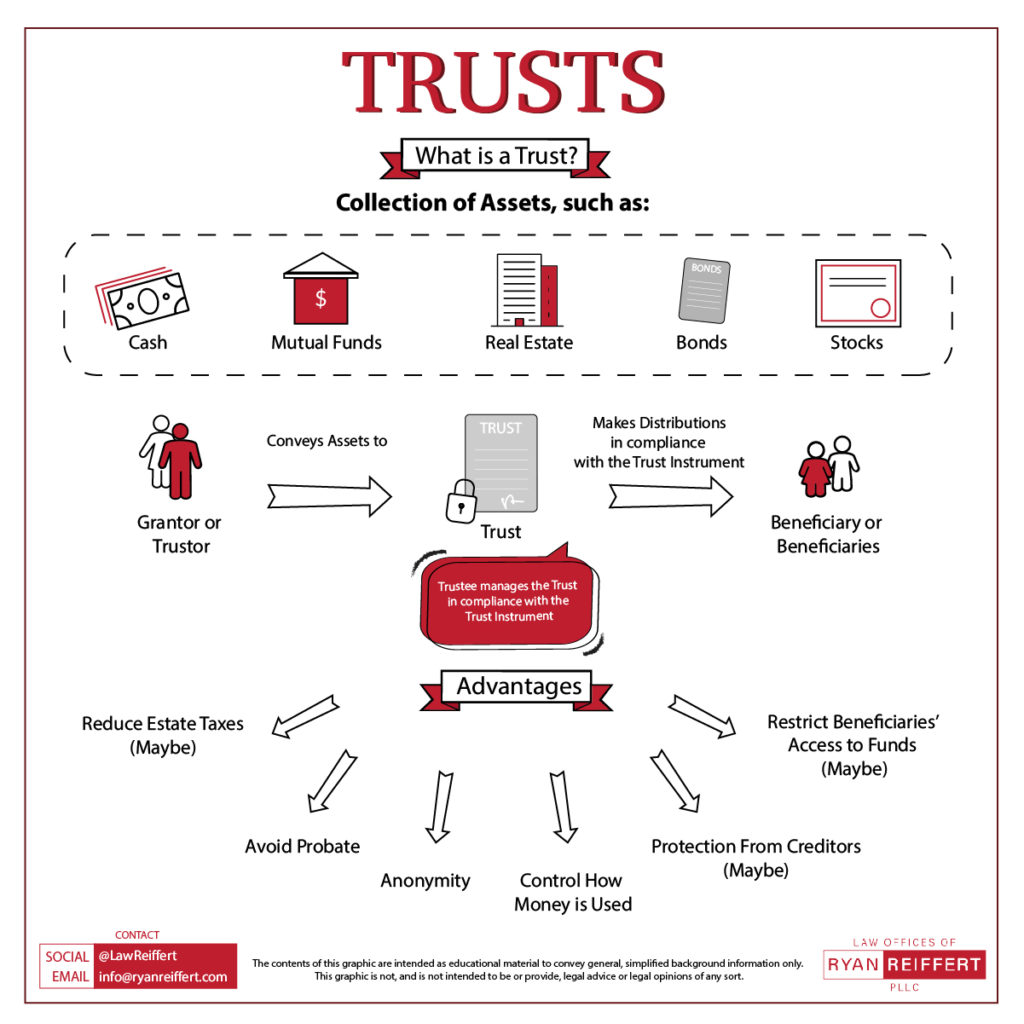

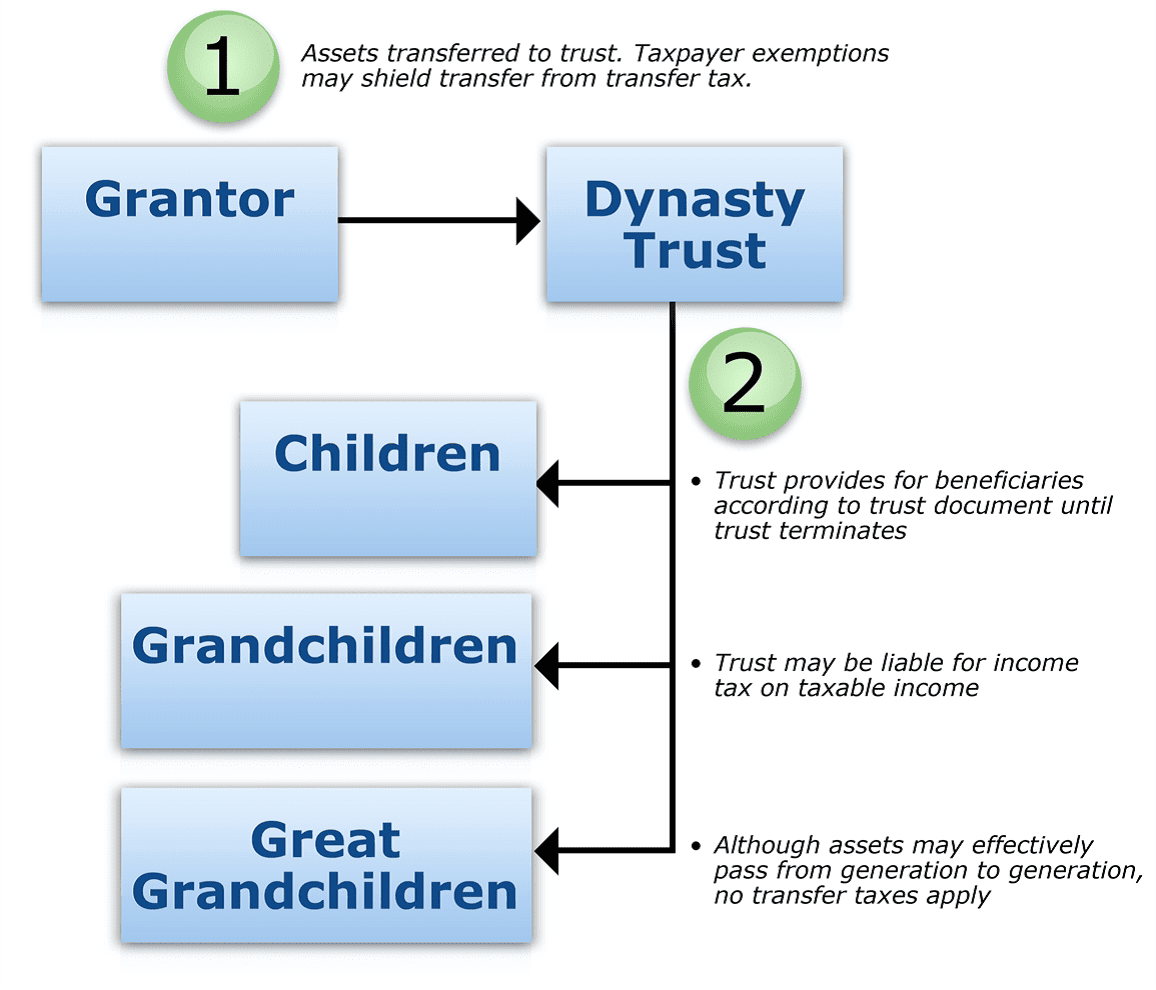

A similar trust, called a dynasty trust, functions like a generation-skipping trust, only it can be extended indefinitely to subsequent generations. As with a generation-skipping trust, the beneficiaries of a dynasty trust can enjoy the income from the trust; however, they never gain control over the assets themselves. federal estate and generation-skipping tax exempt – and creditor-safe –solution until the child’s death. The trust property will then be available either to be distributed estate tax free outright to the child’s heirs, or be held back in a further “generation-skipping protective trust” (“GSPT”) if

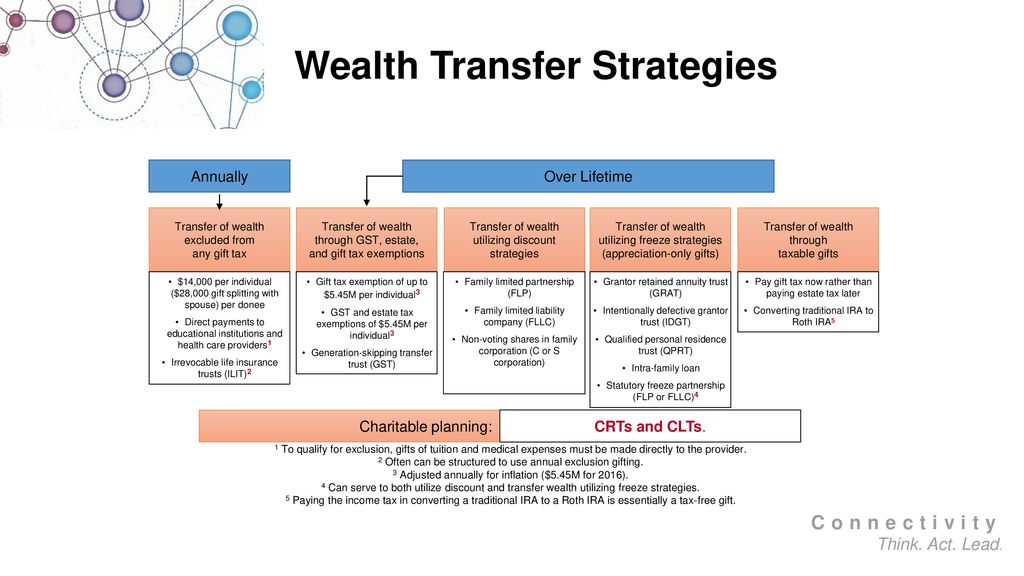

A generation-skipping trust is an estate planning tool designed to transfer assets in a way that avoids some estate taxes. This type of trust, through which assets skip a generation, is also called a GST trust or dynasty trust, because it is often used by affluent families to pass down wealth at a great estate tax savings.

Generation skipping trust diagram

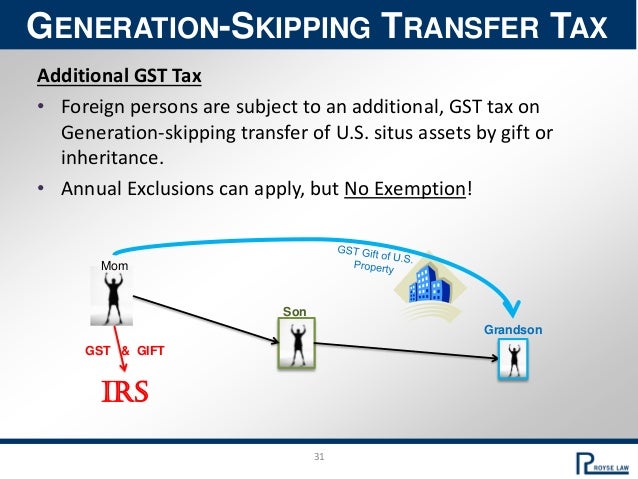

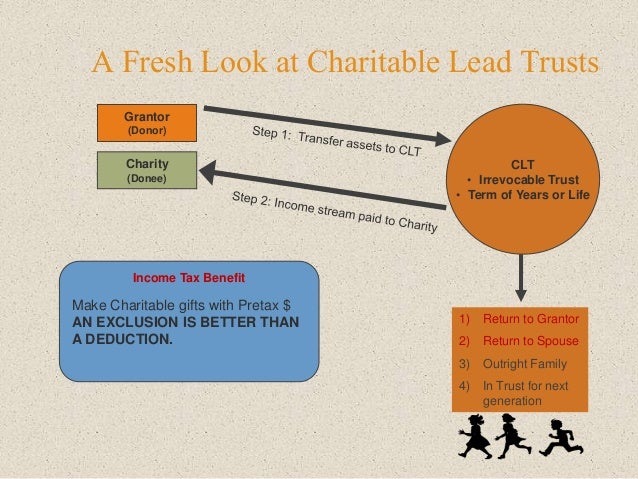

Join us for a free seminar today! If you have questions regarding estate planning, trust contests, or any other trust administration issues, please contact the Schomer Law Group either online or by calling us in Los Angeles at (310) 337-7696, and in Orange County at (562) 346-3209. #estateplanning, #schomerlawgroup, #qtiptrust. A generation-skipping trust, sometimes referred to as a “dynasty trust,” is exactly what it sounds like, a legally binding, specialized, irrevocable trust agreement in which a grantor’s assets are passed down to the grantor’s grandchildren, but not children, to avoid estate tax liability. GSTs are designed to eliminate estate taxes at each generational level for as many generations as ... Generation Skipping Transfer (GST) Tax. Dynasty Trust ... A Dynasty Trust is a type of trust which benefits multiple generations where.2 pages

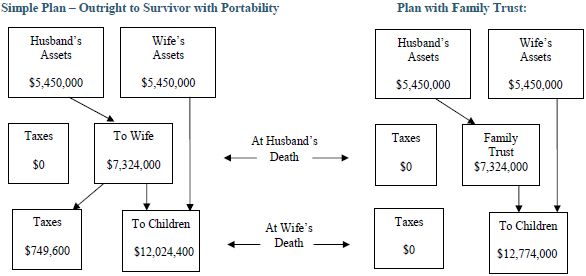

Generation skipping trust diagram. A generation-skipping trust is a useful tool for those with especially large estates. It allows you to give money directly to younger friends or family members, saving your family some estate tax payments down the line. Up to $11.40 million per person is subject only to the estate tax, while any funds greater tjam that amount are also subject ... This trust can remain sheltered for an extended period of time (around 100 years). Even when the inheritance is relatively small (say, $100,000 to $200,000), the ability to protect these assets is valuable. A second but important benefit of the generation-skipping trust is the creditor-protection it affords to the heirs. Consider these points: A generation-skipping trust (GST) is a type of legally binding trust agreement in which the contributed assets are passed down to the grantor's grandchildren, thus "skipping" the next generation ... 30 Sep 2009 — The GSTT is the government's defense against an end run around estate and gift taxes. It imposes a flat tax on gifts and bequests above the ...

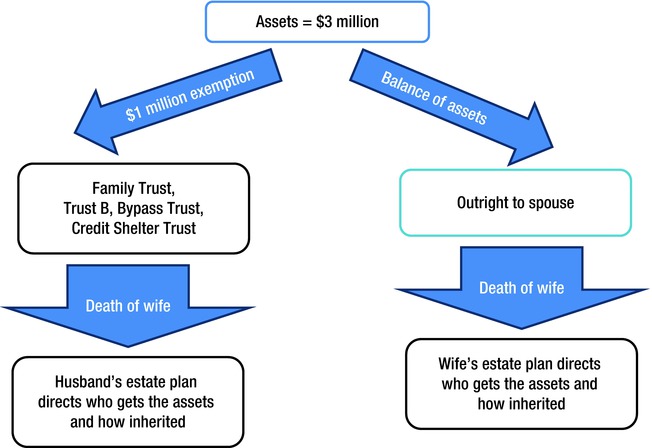

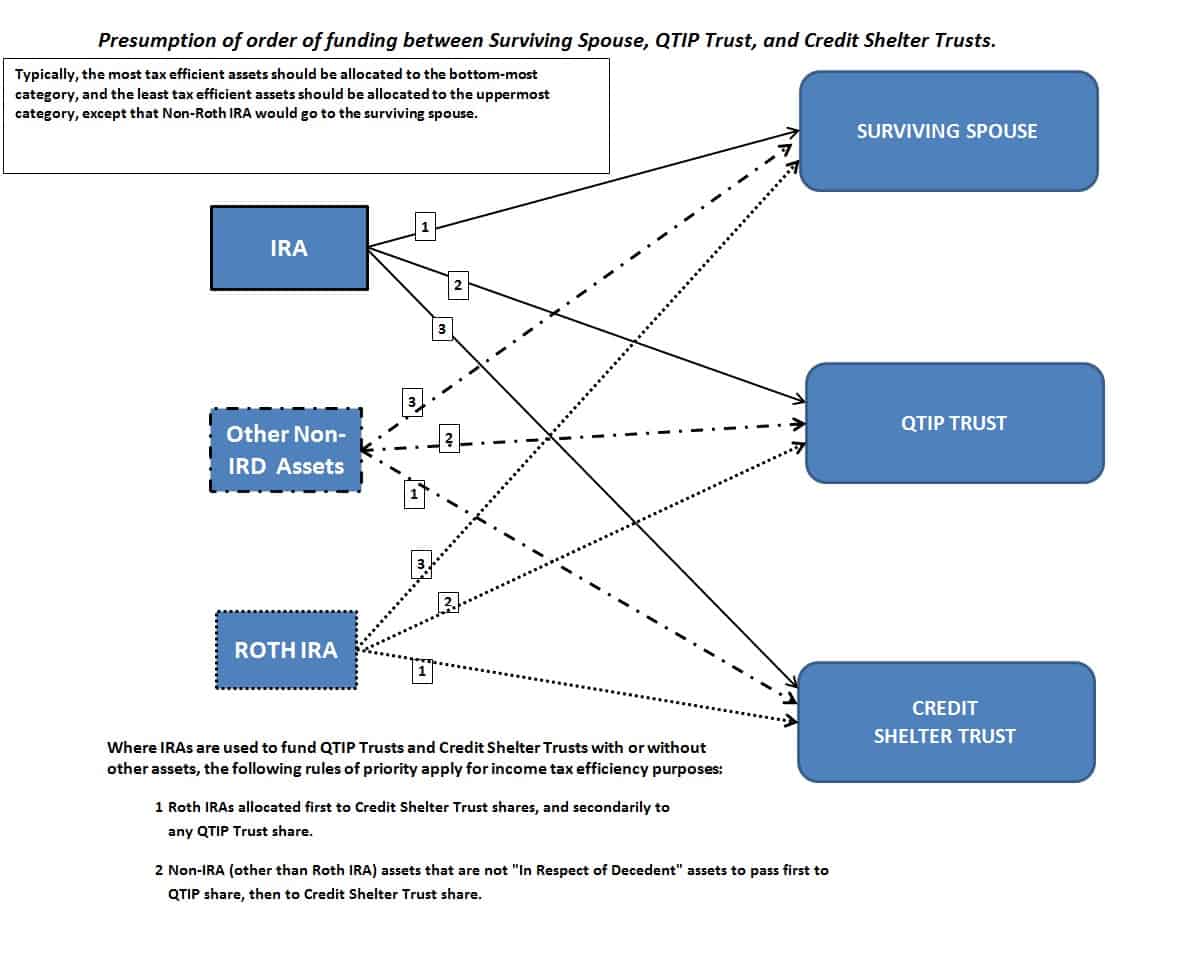

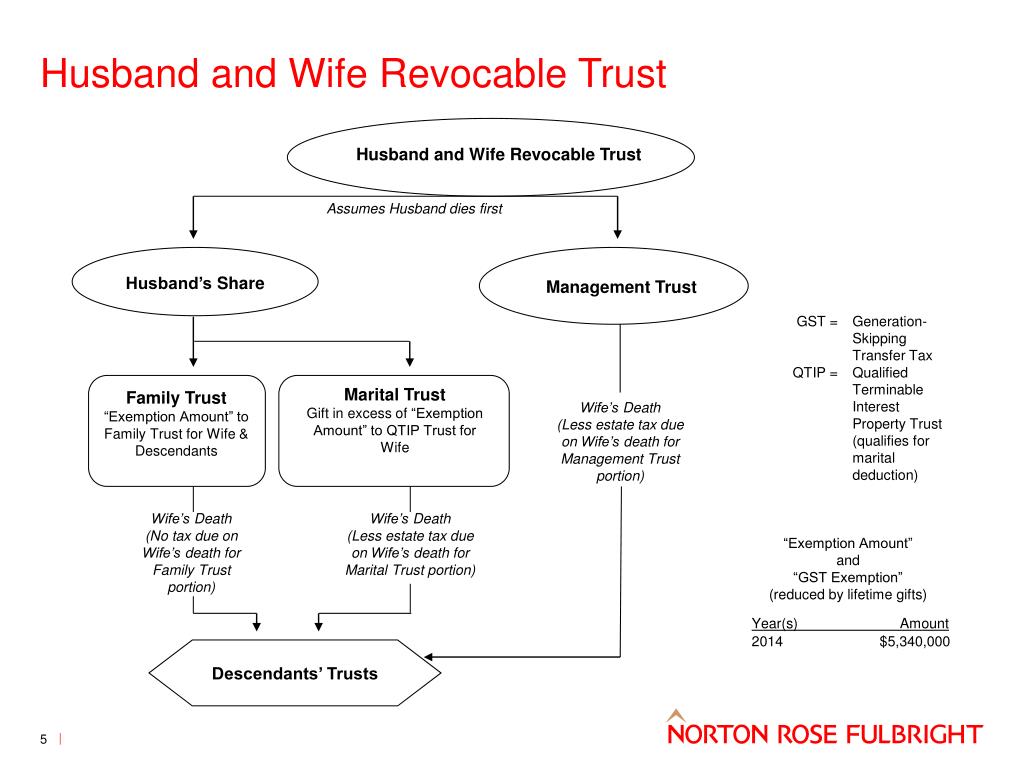

Generation-Skipping Transfer (GST) tax exemption – not portable; use it or lose it. Giving it to spouse or her QTIP trust makes her the transferor to skip persons (e.g., remainder beneficiaries). IRS allows the Executor to REVERSE the transfer of a QTIP in order to qualify it for the decedent’s GST tax exemption. MARITAL DEDUCTION TRUSTS Generation Skipping Trusts ... Every person can pass up to $11,580,000 in 2020 ($23,160,000 for a couple) to his or her grandchildren without subjecting the gift ... Certain types of trusts are known in tax jargon as “generation-skipping trusts”. Provisions in your proposed irrevocable trust agreement (particularly in.4 pages A generation-skipping trust is a type of trust that designates a grandchild, great-niece or great-nephew or any person who is at least 37 ½ years younger than the settlor as the beneficiary of the trust. The goal of a generation-skipping trust is to eliminate one round of estate tax. Generation-skipping trusts offer tax advantages through the ...

The children retain virtually full control of their trusts during their lifetimes. · None of the assets of the Generation-Skipping Trust are includable in the ...Missing: diagram | Must include: diagram Generation Skipping Transfer (GST) Tax. Dynasty Trust ... A Dynasty Trust is a type of trust which benefits multiple generations where.2 pages A generation-skipping trust, sometimes referred to as a “dynasty trust,” is exactly what it sounds like, a legally binding, specialized, irrevocable trust agreement in which a grantor’s assets are passed down to the grantor’s grandchildren, but not children, to avoid estate tax liability. GSTs are designed to eliminate estate taxes at each generational level for as many generations as ... Join us for a free seminar today! If you have questions regarding estate planning, trust contests, or any other trust administration issues, please contact the Schomer Law Group either online or by calling us in Los Angeles at (310) 337-7696, and in Orange County at (562) 346-3209. #estateplanning, #schomerlawgroup, #qtiptrust.

Citizen Engagement In Co Creation Of E Government Services A Process Theory View From A Meta Synthesis Approach Emerald Insight

Security Factors On The Intention To Use Mobile Banking Applications In The Uk Older Generation 55 A Mixed Method Study Using Modified Utaut And Mtam With Perceived Cyber Security Risk And Trust

Justin Miller On Twitter 2021 May Be The Last Chance For Wealthy Families To Transfer Tens Or Even Hundreds Of Millions Of Dollars To Future Generations Without Paying Any Gift Estate Or Generation Skipping

0 Response to "43 generation skipping trust diagram"

Post a Comment